Why CRE Technology Has Become a Necessity Instead of a “Nice to Have”

Many CRE owners looking to draw in new investors continue to rely on now-outdated communication techniques such as phone calls, overnight packages, and e-mail. If it’s not broken, don’t fix it, right? Unfortunately, these methods are broken if you’re trying to attract Millennial investors. Older generations may be content with waiting to receive an investment package in the mail or looking over a static PDF sent via email, but America’s latest generation of investors grew up with technology like online stock trading and mobile banking. Millennials want to have easy access to information at the click of a mouse (or the touch of their finger). As the investment power of this generation grows, ignoring the need to implement responsive technology can mean that CRE owners are risking alienating their youngest but potentially brightest investors.

The Millennial Generation’s Growing Investment Power

As the youngest members of the Millennial Generation are now on the brink of adulthood, the investment power that this group holds is rapidly growing, and this expansion will only increase as the more junior members of this generation finish college, enter the workforce and move up in their careers. Already, over 53.5 million people between the ages of 18 and 34 are gainfully employed according to Pew Research, and the number of Millennials receiving a paycheck is on the rise due to the sheer size of this generation–more than 16 percent larger than Baby Boomers and over a third larger than GenX, as according to Goldman Sachs. These statistics place Millennials firmly at the top of the number of income-earners in the country – and more paychecks mean more buying power. According to Accenture, the purchasing capabilities of Millennials will reach $1.4 trillion each year by the end of 2020.

Moreover, the stereotype of young college graduates moving home to their parents’ basements isn’t entirely accurate for this generation. While the financial crisis of 2008 hit many Millennials hard just as they were embarking on their careers, this resilient generation has bounced back quite nicely. Indeed, the Shullman Research Center found that almost a quarter of America’s millionaires are Millennials, with more than five million boasting a net worth of over $1 million dollars. To put that in perspective: that’s one million more millionaires that the older Generation X can claim.

What does this all add up to? Growing investment potential in a generation just beginning to think about making their money work for them. Millennials’ investment power appears to have already topped their predecessor generation, and more growth is all but inevitable as the generation’s youngest members begin their own professional endeavors.

The Current State of Technology in CRE

Commercial real estate investing has long placed a premium on personal relationships strengthened through face-to-face meetings. For decades, many CRE owners have found that their investors have been pleased with a high-touch but low-tech approach, relying on document-laden correspondence to help familiarize their potential investor base with new opportunities. Yet the Millennial Generation has a strong–and not positive–reaction to this reliance on paper and manual number crunching.

One piece of evidence that should have CRE owners taking a harder look at their technological capabilities: professionals within commercial real estate sharply differ on their assessments of the industry’s technological standing depending on their age. For example, less than a quarter of CRE professionals over 45 think that the sector is lagging behind the overall workforce in adopting new technology, while 65 percent of those under 45 think that commercial real estate is falling behind. Older CRE workers also think that personal relationship skills are the most vital aspect of investor relations; younger workers do agree on the importance of face-to-face interactions, but they see a more critical role for technology to play in bringing in new, young investors.

Perhaps most tellingly, more than half of young CRE professionals clearly identify overall technological trends that could impact the utilization of technology in real estate, including increasing numbers of mobile devices, cyber security concerns and the growth in cloud-based software. Conversely, less than half of older workers think that these technology trends will have a major impact on how they do business.

How the Technological Status Quo Threatens to Alienate Valuable Younger Investors

Almost no member of the Millennial Generation can recall a time before the current digitally connected world. This generation grew up with video games, email, text messaging and online chat. Indeed, even basic interactions like visiting a bank teller that are commonplace to older generations are alien to Millennials who overwhelmingly prefer to conduct their banking business online.

This early normalization of technology has led Millennials to have a much different relationship with new innovations than prior generations. TD Ameritrade found that 37 percent of wealthy Millennials were excited at the prospect of meeting with a financial adviser over Facebook (despite such activity generally being forbidden). On the other hand, less than a single percent of Baby Boomers were willing to do so.

Millennials also love the transparency that technology can provide. A joint Deloitte and World Economic Forum survey found that this generation wants to understand how their money is performing and where it’s going. More than a third of all Millennials in business cited wanting to improve society and understanding their market returns as their key goals.

This desire for technological tools must be set against the background of Millennial’s typical investment activities. Their up-close experience with the Great Recession made them fairly conservative investors, preferring long-term asset classes, passively traded ETFs and plain cash. Wealthier Millennials do favor real estate investments, but the clear disposition for many in this generation is towards less risky investments.

In other words, CRE owners have work to do in attracting a younger investor base. Without bucking the current status quo and integrating more cutting-edge technology into their investor interactions, CRE owners risk alienating the generation most likely to drive overall investment in the decades to come.

Interested in learning more about the changing landscape of investors? Download our white paper: Why Technology Is Critical for Winning Over the Next Generation of Investors.

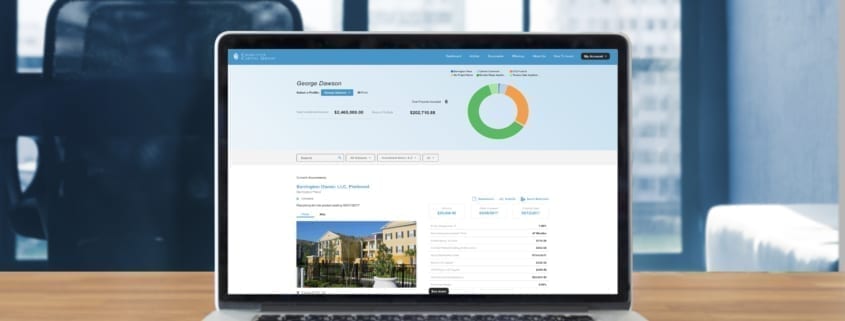

RealPage IMS can help bring your firm’s technological solutions into the 21st century. To learn more about IMS and to schedule a demonstration of our capabilities, please contact us today.