Are You Feeling the Shift? Technology Adoption and Investment Increasing in CRE

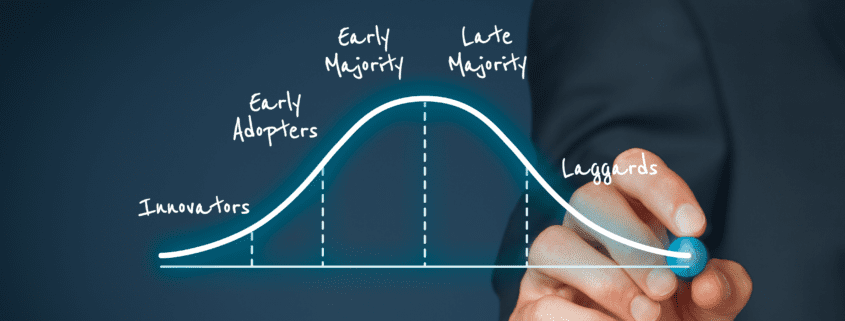

Altus Group recently released its 2019 CRE Innovation Report. This year’s report is titled “The Innovation Opportunity in Commercial Real Estate: A Shift in PropTech Adoption and Investment”. The common theme seen across industry reporting is commercial real estate’s reluctance to embrace technology over the years. But now the industry is seeing an acceleration in both awareness and adoption of technology, which could have major implications for the future.

The Altus Group surveyed 400 C-level and senior executives in commercial real estate who hold both front and back office positions at owner-operator and investor firms around the world. All firms represented had at least $250 million of assets under management (AUM) at the time of being surveyed in the fall of 2018. The collective group represents an approximate total AUM of over $2 trillion.

Over the last few years, there has been a new focus on using technology to optimize internal process and external transactions by forward-thinking CRE firms. “The industry is at a turning point in embracing technology and has entered a state of experimentation, adoption and investment as new technologies and applications continue to emerge,” says the Altus Group. The emergence of purpose-built commercial real estate solutions has accelerated due to increased levels of engagement and investment from the industry.

Continue reading to learn about some of the pain-points and inefficiencies that the industry’s innovators are focusing on solving.

Data Access

The commercial real estate industry relies heavily on data and flow of information. Whether a group is attempting to identify their next deal, manage and run a property more efficiently, or exit a current investment at the right time, data is crucial to making the right decision. The only problem is that those critical data sources being used to make these decisions are siloed within disparate systems, and it is a challenge to piece actionable insights together in a timely manner. According to the Altus Group, “CRE firms are still using spreadsheets as their primary tool for key processes: 60% for reporting, 51% for valuation and cash flow analysis, and 45% for budgeting and forecasting.”

Data aggregation tools, like Key Property Insights (KPI) from IMS, are taking siloed data sets and integrating them to generate reports that provide actionable insights in an instant. Tools like KPI give an overarching view of aggregated data from a portfolio level to line-item expenses.

Back Office Efficiency

The findings from the survey reveal that a key priority for CRE executives is driving efficiency through automation. Use of spreadsheets in critical functions is still commonplace for the industry. But these spreadsheets have created risks and challenges for organizations, and they inhibit efficiency around data administration and management. But the bigger issues are dangers posed by human error and key person risk. Various studies report that nearly 9 out of 10 spreadsheets (88%) contain errors. Key person risk, which is risk associated with departure or absence of the person who knows the spreadsheet, is common, difficult to mitigate, and potentially disastrous for some organizations.

As previously mentioned, spreadsheets are still being used by a vast majority of respondents for crucial business functions. But there is hope because the number of automation options on the market are increasing. For example, RealPage IMS offers a tool to automate and streamline waterfall formulas and calculations, using customizable templates to maintain compliance and seamlessly connecting to distribution processing. Waterfalls can be calculated with just the click of a button, and the approval workflow is customizable to ensure all stakeholders have had the opportunity to review.

Transaction Speeds

Disintermediation through technology solutions is one of the most notable trends of the last few years. Many view the layers involved in financing, funding, and transacting processes to be unnecessary and inefficient. More direct lines of communicating and transacting between buyers and sellers, lenders and borrowers, and investors and funds are being sought after. The emergence of transaction-based online platforms like crowdfunding (e.g. RealCrowd), lending marketplaces, and online property exchanges is proof of that. According to the survey, 61% of respondents are already using or trying online lending marketplaces and 60% are using or already trying online investment marketplaces and crowdfunding.

Just like with funds, demand from investors for streamlined transmission of information and transparency is being demanded by at the single asset syndicators as well. Providing an investing experience that is on par with what investors receive through online brokerage accounts is moving from a nice-to-have to a necessity. Instant access to investment history, tax documents, and quarterly reports through investor dashboards will reduce the amount of time organizations spend on administrative investor support tasks and allow them to dedicate more time back to value-add activities.

While many CRE firms are still holding on to traditional ways of managing their business, the vast majority of survey respondents agree that the technology solutions discussed above will make a massively disruptive impact on the commercial real estate industry. CRE organizations have moved past the stage of questioning the value of technology solutions to actively testing and applying them to their business as well as investing in technology themselves.