Inflation on the Rise: Commercial Real Estate Investments as an Inflationary Hedge

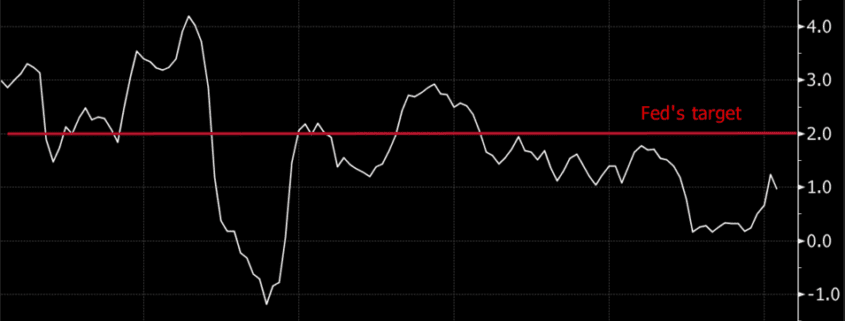

BlackRock and Pacific Investment Management Company (PIMCO) are both cautioning investors about higher than expected inflation. Wes Goodman posted an article on Bloomberg that indicated investors may not be pricing in enough inflation risk in the credit markets according to the experts. In the article, Goodman quoted Richard Turnill, BlackRock’s global chief investment strategist, as saying, “Stabilizing oil prices and a tighter labor market could contribute to rising actual, and expected, inflation.” PIMCO had similar views on a video on their website noting that Treasury Inflation-Protected Securities (TIPS) are pricing in 1% inflation and they expect it to get close to 2%.

BlackRock’s Turnill suggests that inflation-linked bonds and gold are good diversifiers for a portfolio in an inflationary environment. Other experts, such as TIAA-CREF’s Martha Peyton, tout that commercial real estate has historically outpaced inflation. Traditionally, real estate rents increase with inflation, thus protecting the owners. Commercial real estate can also be a lower volatility asset, provide current income and tax advantages, and have potential appreciation with solid management and demographics.

TIPS are better correlated to inflation than all the other traditional options. But, in the meantime, TIPS pay about a 1.5% coupon. That is not exactly going to move you toward retirement like commercial real estate appreciation can.

Check out Martha Peyton’s article “Is commercial real estate a hedge against inflation?”

It’s a good read.